Best Banks For Students Loan In Nigeria And Loan Apps Without Collateral

Just like every other thing that attracts huge interest, education doesn’t come cheap. As such, there are now platforms where you can get a student loan in Nigeria to finance your schooling, This tutorial will give you the full details on the Best Banks For Students Loan In Nigeria And Loan Apps and everything you need to know.

Content Inside

A student loan is designed to help students pay for education and its associated fees, A student that has financial difficulty can apply for the loan provided they meet the requirements for a student loan.

Banks That Offers Students Loans In Nigeria

Below are the list of the nigerian banks that offers students loan effectively;

- Access Bank

- GT Bank

- First Bank

- Education Bank Loan

- Guarantee Bank Student loans

The Types of Students Loan

- Loans from Federal Government

- Loans From Loans Board

The Types Of federal Students Loan

There are four types of federal student loans available Which are:

- Direct subsidized loans

- Direct unsubsidized loans

- Direct PLUS loans

- Direct consolidation loans

Students Loan Requirements

- Acceptance letter

- Proof of Academic Results

- Proof of Costs

- FICA Documents

Best Loan Apps For Student

- Fair Money App

- Branch Loan App

- Aella Credit App

- Pay later Loan App

- Okash

- Quickbuck

- Kwik Money

- Ren Money

- Palm Credit

- Credit Ville

- Kiakia Loan

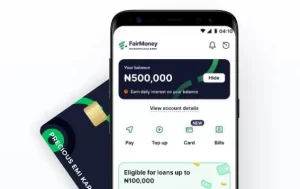

FairMoney App

Fairmoney App Loan amounts range between ₦1,500 to ₦1,000,000 with repayment periods from 61 days to 18 months at monthly interest rates that range from 2.5% to 30% (APRs from 30% to 260%)

An example of a FairMoney loan

Borrow ₦100,000 over 3 months

Interest (total cost of the loan): ₦30,000 (30% rate)

Three monthly repayments: ₦43,333

Total amount payable: ₦130,000

Representative: 120% APR

Branch Loan App

Branch Loan App is an online moneylender that provides single payment loans, installment loans and payroll loans for borrowers. The amount borrowed is then deducted from your account. The platform offers instant loans that help people achieve their business and personal needs.

How to Repay Branch Loan

- Open up your Branch Loan app

- Select ‘My Loan’

- Click on ‘Tap to pay

- Put in the amount of money you intend to pay back

- Select your preferred method of payment – bank or debit card

- Click ‘continue

Aella Credit App

Aella Credit is seen as a Loan app in Nigeria pioneering access to instant loans. Apart from loans, it’s also an investment platform and a marketplace for health insurance. It’s close to a one-stop shop for all your business needs.

How to access Aella Credit

- Download the Aella Credit app

- Create your account

- Update your profile

- Check your eligibility

- Apply for the loan

- Only borrow what you need! Remember, loans aren’t free money. You will need to pay back

- Receive the funds in your bank account

Pay later Loan App

PayLater is a service that allows you to consolidate your spend on Grab services and pay next month. When you activate PayLater, you get instant access to a pre-approved PayLater amount that can be used for your Grab Mart, Car, Taxi, Express and Food transactions.

How To Apply For PayLater

1. Download the app from the Google play store on your Mobile phone

2. Register your personal details

3. Choose your desired loan amount and duration

4. Submit your application. You will get a loan decision in seconds.

5. If approved, your account is credited within 5 minutes.

Okash

Okash is Opay’s automated lending service focused on increasing access to credit to financially under-served/excluded individuals in Nigeria.Their loans are provided in partnership with Blue Ridge Microfinance bank. If you are unable to repay your loan via direct debit, you can pay or transfer to the Blue Ridge Microfinance Bank Ltd.

The Need For Okash

- Fast and secure processing of loan payments

- No collateral and deposit requirements.

- Easy sign-up process

- They offer incentives such as bonuses from time to time.

- You can do the whole process online on your mobile phone. You don’t have to pay a physical visit to any bank before going through the required process.