Simple Method How To Block Access Bank Account (Without Going To The Bank)

Sometimes, no matter how hard you try, you can’t get your spouse to stop squandering your hard-earned money on shopping sprees and weekend getaways instead of saving it for bills.

Content Inside

The best solution for you is to close down access to your bank account to prevent them from drawing any more funds out of it in the future.

Here’s how you can block access to your bank account in order to protect yourself from financial ruin.

1. Cancelling automatic payments

You can cancel automatic payments by calling your bank and telling them that you want to do so.

They will give you a new card number, with the old one cancelling automatically.

The only downside is that it can take up to a week for all of the automatic payments on your account, like subscriptions or online shopping, to stop.

2. Putting a stop to checks

When you write a check, it is not authorized for withdrawal from your account until the bank has had a chance to clear it. If you want to stop someone from withdrawing money from your account, all you have to do is put a stop on your check.

You will also need to provide them with any details they may need such as the reason why you are stopping access and how much time should pass before the access can be reinstated.

Once this information has been submitted, the person will no longer be able to withdraw money from your account unless they show two pieces of identification matching what was provided in their request for stopping access.

3. Freezing your credit

If you’re in the process of filing for bankruptcy, or you fear that your account may be compromised, then it’s possible that you’ll need to freeze your credit.

This can be done by contacting each of the three major credit bureaus and asking them to place a fraud alert on your account.

Remember that this can only last for 90 days so if you don’t think an unauthorised person is going to try and access your account within that time frame then it’s not necessary.

You also want to make sure that when you go into the bank, they take note of what type of security steps have been taken to protect your account before continuing with any transactions.

Asking your bank to close your account

You can totally close your access bank account if you no longer want it. In order to do so, go into your bank and tell the customer service representative that you want to close your account.

They will then ask for some personal information such as name, address, social security number, and date of birth.

After this is submitted, you will be asked if you would like a check mailed out or if you would like the funds electronically transferred. Choose which one works best for you.

How to Block Access to my Bank Account?

Dial *901*911# to block access to your bank account. There are three ways to block access:

1. By dialing *901*911#,

2. By calling the access bank customer care at 01 280 2500, and ask for a temporary phone PIN, or

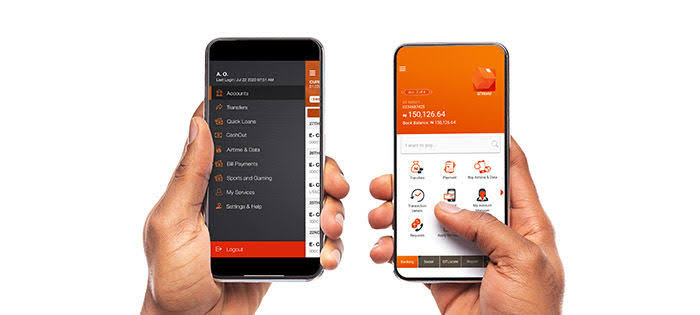

3. By accessing your bank app and blocking your debit card from debiting your accout.

See Also: How To Withdraw From TikTok

How do I block access to my bank account without a PIN?

Dial *901*0# and follow the prompts. This will block your account until you dial *901*0# againagain, or enter a PIN number.

Conclusion

If you’re travelling and you know you would be leaving behind your Access bank to avoid it getting stolen or lost or maybe you are going on an extended vacation, it’s a good idea to block access to your bank account.

If you need money while travelling, you can get cash advances from your debit card by withdrawing cash from an ATM with your debit card, by so doing if someone tries to take money out of your account and they’re not authorised, they won’t be able to do so because the bank will see that the funds aren’t available.