How Do I Complete My KYC on GREY? Utility Bill and Face Verification Made Easy

Grey.co (Aboki Finance) is a financial technology company, not a bank. Banking services are provided by licensed banking partners.

Content Inside

Unlike other Microfinance Bank Apps like OPay, Kuda and Barter, you do not need Nigeria BVN to fully verify and complete your grey KYC.

Creating account is as easy as filling in your personal information that you already know and will to share to secure your account.

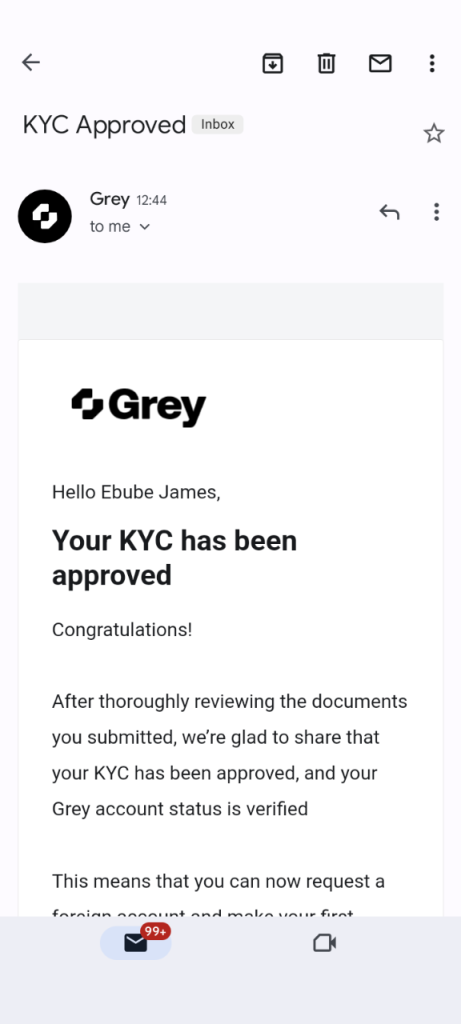

I created my grey.co account today and got it verified under 24 hrs and I want to share with you how to create grey.co account and alternative for utility bill payment that will be accepted.

below is the proof that I got my account approved with this method;

Before I arrive here, you have to first create account with grey.co app.

Let’s look at how to create grey account, step by step using grey.co or the grey app from Google play store/ app store.

How To Create Grey.co Account

- Download the Grey app or visit grey.co website.

- Click on “Create a free account” (You’ll be redirected to the sign-up page)

- Complete the form on the sign-up page: fill in your Legal name as it appears on your ID, phone number, email address, and password.

- Enter referral code (optional) – learn more about our referral program here.

- Click on “Create your account.”

A one-time passcode; is sent to the email address you provided once you have successfully created an account.

Kindly login to your email inbox to access the mail Grey sent to you.

If you didn’t receive an email to your INBOX, please check your PROMOTIONS, UPDATES, or SPAM FOLDER.

However, If you didn’t receive a verification code from Grey, click on resend code, and the email will be resent to you.

KYC means Know Your Customer; after successfully creating your account and verifying your email, you’ll need to complete your KYC Verification.

Before you can make a transaction on Grey, it is expected that you must have completed your KYC to checkmate fraud.

Here’s a step-by-step guide to completing your verification.

You’ll be directed to the KYC verification page once you successfully verify your email.

If you previously chose to complete your verification later, log in to your account and click on the KYC verification to access the verification page.

Select your gender.

Input your occupation or line of business, and ensure to fill in a clear line of business/occupation (Business, Self-employed… e.t.c are all ambiguous)Select your country and state.

Input your city and Zip-code.Enter your home/residential address.Upload a utility bill clearly showing your home/residential address.

The utility bill could take the form of a tenancy agreement, delivery receipt in your name to the address, bank statement, NEPA bill, etc., and should be within three months.

Select your purpose for signing up on Grey.

Click on the continue button to submit and move to the next step.

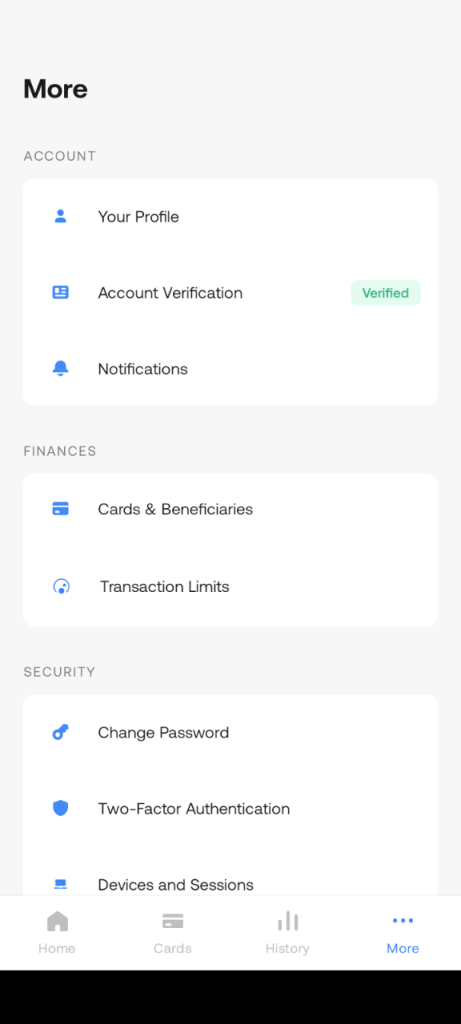

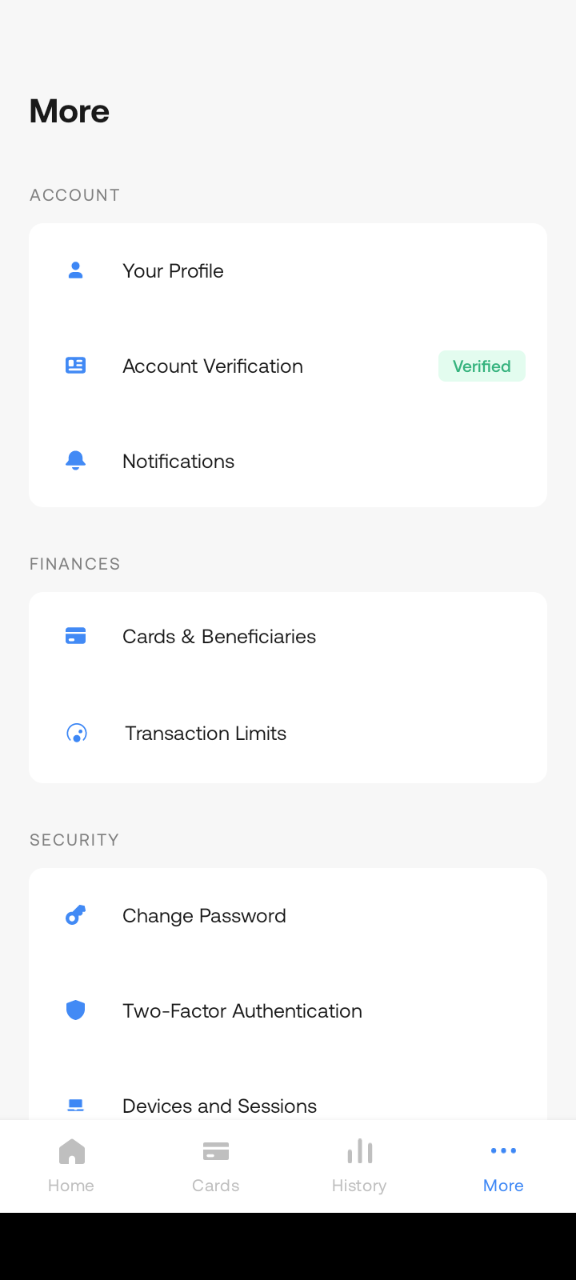

After successfully creating your account, verifying your email, and completing your KYC, you’ll need to verify your identity. Before you can make a transaction on Grey, it is expected that you must have completed your KYC and document verification to checkmate fraud.

Here’s a guide to completing your document verification:

- Sign in to your account after you have verified your email.

- On the home page, click on the “Complete verification” button.

- You’ll be redirected to the document verification portal, do ensure to follow the prompts.

- You are required to upload the following :

- An image of your Valid Government-Issued ID (Driver’s license, national ID card, or International passport). A photo of your original valid ID is required ✅ and not a copy (Scanned/photocopied). ❌

- A short video of your face.

- A photo of your original valid ID is required ✅ and not a copy of it (Scanned/Photocopy). ❌

- All four corners of your ID should be visible.

- All details on your ID should be clear and legible; any missing information renders the document invalid; turn off your flash to avoid any glare on the document.

- Edited and altered documents are not supported.

- The person on the ID must match the video selfie.

- The details on the ID must match your Grey account.

- Take the video in a well light room and ensure your face is clear in the video. Once you have completed the process, you’ll be redirected to a successful page. Your document will be reviewed, and will receive a successful mail once verified. Please note that documents are usually reviewed within a few minutes to 24hrs. Once your document is verified, you can create virtual foreign accounts in our supported currencies or convert funds.

If your KYC Verification failed because you are unable to provide accurate Utility Bill file, I used my NIN brown slip and I got verified easy.

Here some reason why your verification process may failed.

Why did Your Grey verification fail?

Name Mismatch – Ensure to sign up with your legal name as it appears on your documents.

Under age – You must be above 18 years of age to use Grey.

Template and Country mismatch- Selecting a wrong document type or country- e.g., Selecting an International passport and uploading a driver’s license, Selecting Nigeria and uploading a British ID.

In conclusion; creating and verifying grey account is very easy but if you are unable to get verified with the automatic process, you can contact grey.co customer Support.

Hope this guide help you find ways to get your grey account Verified.

![[Complete] List Of Nigerian Banks And POS Charges](https://vtuscript.com/wp-content/uploads/2022/11/images-92.jpeg)